Case Studies

Our work has impacted the learning objectives of

leading brands

ING

Rapid eLearning Solution for a Bank in Australia

A to-the-point and rapid eLearning solution to educate the bank staff about the Foreign Account Tax Compliance Act (FATCA) obligations and ways to meet them.

The Client

A leading bank in Australia owned by a multinational finance group. The bank was named Australia’s Most Recommended Bank by the Nielsen Consumer Media View in February 2015. The organization has bagged a number of awards highlighting excellent banking services and products offered by the bank. These awards include Australian Lending Award 2013 for the best customer experience, International Customer Service Professionals People’s Choice Award 2014, Money magazine’s Best of the Best Award 2015, among others..

The Requirement

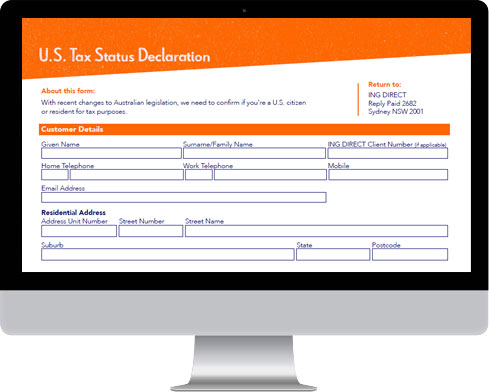

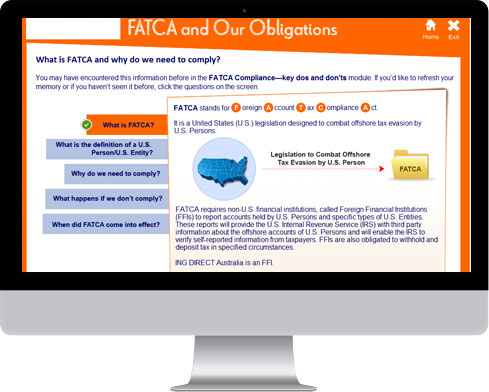

The Foreign Account Tax Compliance Act (FATCA) of the U.S. targets non-compliance by the U.S. taxpayers using foreign accounts. The act requires that the Foreign Financial Institutions (FFIs) provide information about financial accounts held by the U.S. persons and entities to Internal Revenue Service (IRS). Australia ratified the agreement with the U.S. on April 28, 2014 and announced the date of enforcement as July 1, 2014. This required all the financial institutions across Australia to comply with FATCA in the stipulated timeline.

While the FATCA policy document was shared with all the employees, the client wanted a solution that would reach the bank staff across Australia effectively and help them understand their role in complying with FATCA on a fast-track basis. The client wanted an eLearning solution that would:

- Provide the bank staff an overview of FATCA along with key FATCA terms

- Explain the bank staff obligations with regards to FATCA and the ways to meet them

- Help the bank staff understand as to how FATCA impacts customers and third parties

More importantly, the client wanted an eLearning solution that would make it easier to update the program for any future updates in the law.

The Challenge

The client provided SKILLDOM with the FATCA documents. The challenge was to:

- Understand the FATCA guidelines

- Analyze how the FATCA guidelines impact the employees and the services offered by the client

- Meet aggressive timelines and deliver the solution in time helping the employees get well-versed with FATCA guidelines

The Solution

SKILLDOM design team came up with an eLearning solution that would not only present the intricate content in an easy to understand manner but also provide an enriching learning experience. Key features of this eLearning solution were:

- Detailed Customization: The course was highly customized according to the client’s branding guidelines. Some of the key elements of customization were:

- GUI Elements and Course Font: Various GUI elements and the font used across the course were customized according to the client’s branding guidelines. SKILLDOM’s systems were optimized to meet this specific requirement.

- Custom Templates: In spite of the course being developed using an authoring tool, thanks to SKILLDOM design team, custom templates were developed within the authoring tool. In addition, rich animation videos were developed in flash and integrated in the authoring tool.

- Interactivities: Use of authoring tool did not stop SKILLDOM from providing an engaging experience to the learners. SKILLDOM developed an activity based on the bubble game. This activity presented various FATCA indicators inside bubbles and learners were required to identify the indicators that highlighted FACTA compliance. This also required learners to beat the clock and avoid bubbles with incorrect indicators.

- Flexible and Rapid Approach: During the course of project cycle, the eLearning program was updated a number of times according to the new inputs received regarding FATCA. SKILLDOM’s flexible and rapid approach ensured that all such inputs were incorporated effectively and quickly. Moreover, the eLearning program was designed and developed such that, it provided flexibility to the client in terms of updating the program for future additions or revisions in the law.

The Impact

Client highly appreciated SKILLDOM’s agile methodology and understanding of FATCA implications for the employees. The result was an effective eLearning solution that prepared the employees to work efficiently when the act was in force. The bank was able to meet a legal obligation effectively and ensure that the staff across branches was ready and prepared by the time the new regulation was in force.

Key Features

Custom Learning

Innovative Approach

Interactive Games

Agile Development